Digital Next Banks with AI/ML powered Platforms of Intelligence

Banks today have access to the vast amount of customer, product, and operational data. The data is from internal and external sources that include streaming real-time data from sensors, devices, mobile apps, IoT and enterprise data centers. Banks are also struggling with the usage of unstructured data such as comments, complaints, emails, etc. besides the structured data lying archived. As the volume, variety, and velocity of the data continue to increase, banks need to find new and better ways to harness the insights hiding in their data to deliver more value to their customers, seize new opportunities and respond effectively to continuous disruptions. Digital next banks are making significant investments in emerging technologies to modernize infrastructure & data engineering and personalization of customer services through the use of Artificial Intelligence/Machine Learning (AI/ML)-based insights. This investment becomes a critical success factor in increasing a bank’s market share. Restructuring traditional products, upgrading legacy infrastructure and optimizing processes to make them simple and efficient add to the success.

Platform-enabled transformations

The banking industry is data-intensive with typically massive sets of unused and unappreciated data. New models of platform-based data mining and advanced analytics techniques can leverage the data, equipping digital next banks to target the right customers for acquisition/upgrade, reduce churn, manage market uncertainty, minimize fraud and control risk exposure.

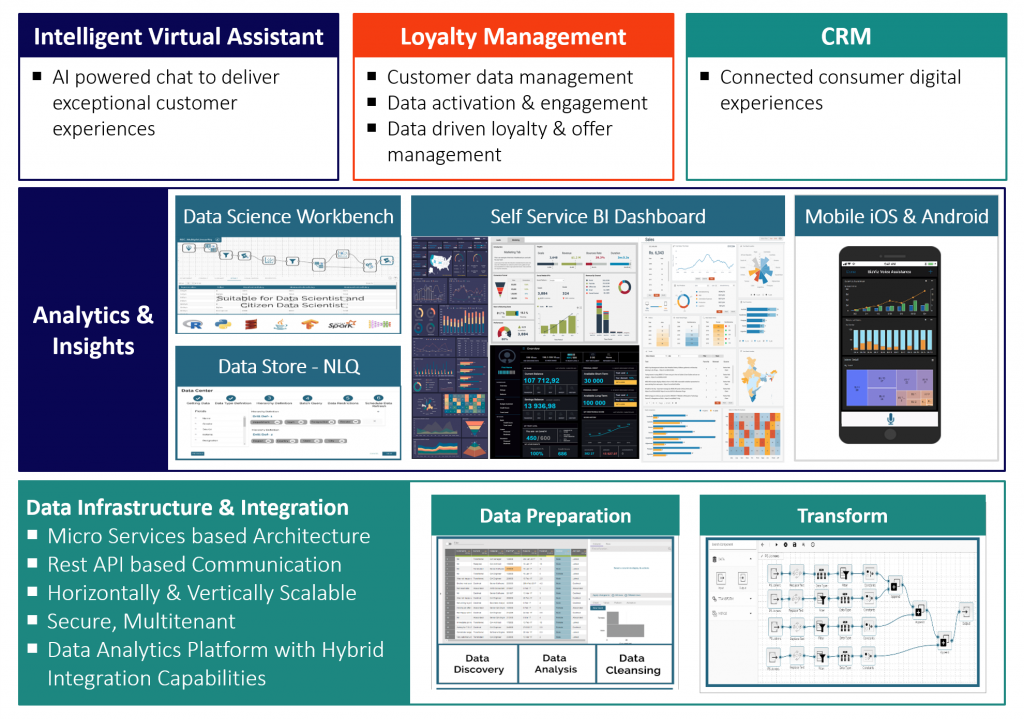

ITC Infotech’s Banking Intelligence Platform is an end-to-end integrated AI, Data Science and Analytics platform that ingests manages and analyzes large amounts of data. It uncovers hidden patterns, correlations and deeper insights to innovatively visualize results for better decision making. It is a combination of leading technologies on the cloud with AI/ML capabilities, Natural Language Processing, Real-time Data Processing, Predictive Customer Touchpoints, Customer Relationship Management, Loyalty Management, Governance, Risk & Compliance and Advanced Analytical Models.

The platform, with its predictive customer touchpoints (like AI-powered chatbots), can be used to personalize product recommendations based on parameters such as customer account balances, transaction history, demographics, customer behavior etc. In addition, the platform uses Intelligent Virtual Assistants, that can be integrated across web pages as well as mobile applications, to make routine customer services fast and accurate and thereby enhance the overall customer experience.

Customer life cycle management is increasingly moving towards the cloud which integrates various functions and provides a 360-degree view of customer financials, including channel transactions, account opening and closing, default, fraud and customer attrition. Contact & Lead Management and Loan/Deposit Workflows are going completely paperless and contactless without the need for customers to visit branches. Advanced Analytics is providing customers with instant information on products along with pricing recommendations/optimization. It also provides the bank the vital ability to cross-sell/up-sell, create customer churn predictions and improve performance.

New trends like incentivizing retail customers for deposit/loan referrals are picking up. Various personalized offers and promotions are being made to customers through the use of Loyalty Points. Mobile Apps are being developed for Loyalty Management and Loyalty Points Redemption. Offer Management, Campaign Planning and Audience Management are integrated with Cloud-Based Architectures.

Social media and sentiment analysis provide actionable insights and quantifiable predictions about customer behavior. It also assesses brand awareness and can measure the success/failure of campaigns. Unstructured data analytics incorporates information from online discussion forums, social networks and call scripts to determine customer sentiment or market opportunities.

Insights about customer behaviors like shopping patterns, lifestyle, eating habits, credit history, spending habits etc. can be uncovered through multivariate descriptive analytics, as well as through predictive analytics. It can help improve a bank’s ability to segment, target, acquire and retain customers. Additionally, improvements in risk management and understanding the customers enable digital next banks to maintain and grow a more profitable customer base.

Risk analytics for credit risks, market risks and operational risks such as digital credit assessment, advanced early-warning systems, next-generation stress testing, credit-collection analytics etc., are performed by applying risk indicators to large datasets to detect risks that would otherwise remain hidden.

- Natural-language analytics are used to understand questions, context and semantics and analyze terabytes of data to identify and rank likely answers

- Algorithms are created to measure their own accuracy and feed that information back into the model to create self-improving predictive analysis

- Real-time analysis of data sources, such as financial markets, stock exchanges, or news is performed to gain risk insights

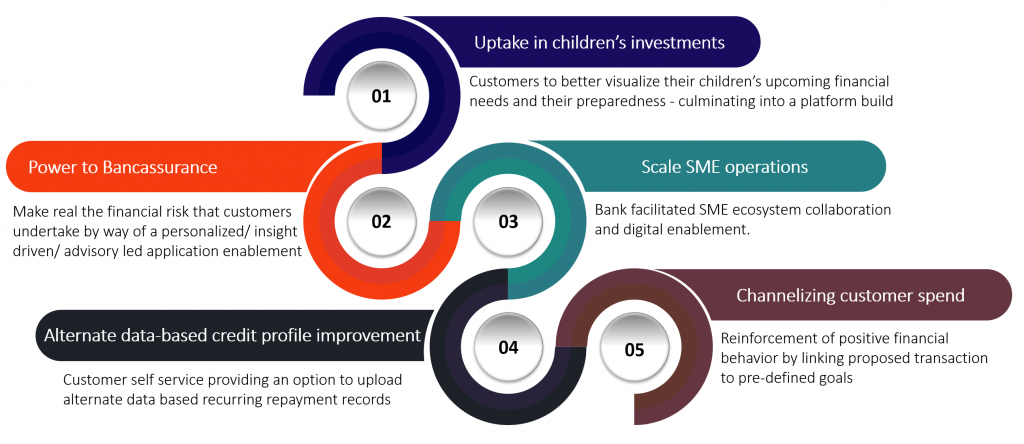

Leading use cases for banks

Kick-starting an effective use case

Implementing platforms of intelligence across the bank can be a daunting and potentially expensive prospect due to:

- Complex, heterogeneous technology architectures

- Operationally optimized but siloed processes and systems

- Data fragmented across multiple databases

- Constrained investment budgets with competing agendas

- Lack of skilled resources

- Perception that the available data lacks the quality to support analysis

All of these are genuine obstacles. However, it should not be assumed that analytical insight cannot be extracted until all the obstacles have been overcome. That road leads either to major programs striving to create perfect data that can answer any question or to an acceptance that any such effort is futile. Organizations do not necessarily have to solve all these issues to initiate an intelligent platform project and put it on the path to success.

A more pragmatic approach starts with selecting a critical question or objective, identifying the necessary data and recognizing that the data is not perfect. This allows the business to derive answers and information correlations with a corresponding confidence level. This approach does not replace the strategic architecture investment required to reach accuracy, but it provides a framework for business owners to control the level of their expenditures in a way that is proportionate to the benefit unlocked.

AI/ML based platforms of intelligence is the way forward for digital next banks across the world which can transform how banks analyze data, breaking down siloed decision making and improving overall customer experience. It can enable banks to respond quickly to disruption, propel the business forward and outmaneuver competitors in the market.

Author:

Abhiram Shankara

Lead Consultant, DATA